All Categories

Featured

Table of Contents

These different investment systems allow you to check out real estate, start-ups, and tech options also. By using these systems, new financiers can learn more about lots of sorts of financial investment alternatives while getting real-life experience. Keep in mind to heavily vet the firms before spending as crowdfunding is not greatly regulated and is riskier than typical investment sources.

All investments are dangers yet with the ideal assistance, you can have much more self-confidence in your decisions. Diversification and Risk Monitoring- by diversifying your portfolio you also diversify your threat. Not all financial investments have the exact same timelines, incentives, or threats. This is the very best means to develop a financial investment foundation and develop lasting wide range.

Due persistance is the very best means to comprehend the investment, the sponsor, and the threat elements. If an enroller isn't eager to review danger, benefit, and timelines, that is a red flag. Successful Non-Accredited Financier Participation- Some firms use the ability to invest together with them such as This company allows retail capitalists to gain easy revenue by using their system to invest with an equity REIT.

What is included in Accredited Investor Commercial Real Estate Deals coverage?

Crowdfunding is open to all capitalists but non-accredited are regulated on financial investment amounts based on revenue. Exception 506 B- allows up to 35 innovative unaccredited capitalists to get involved together with recognized investors.

To remain certified they must comply with regulations regulating personal placements found in. Compliance Requirements for Syndicators- Prohibits organization reference settlements for anybody various other than SEC-registered brokers Non-accredited financiers receive added disclosures Enrollers have to offer offering records Investor Security Steps- The regulations secure financiers from fraud and make certain that openly traded business provide precise monetary information.

Spending with realty crowdfunding systems can be an eye-catching option to getting home the conventional means. It lets you pool your money with other capitalists to enter on offers you couldn't access otherwisesometimes for as little as $10 (Private Real Estate Deals for Accredited Investors). It additionally makes expanding your property profile throughout multiple residential properties very easy

Capitalists profit from residential property gratitude, understood at the end of the holding period, and normal rental earnings, distributed quarterly. As with a lot of genuine estate, Arrived considers its residential or commercial properties long-term financial investments.

Approved and non-accredited investors can after that purchase shares of homes for as low as $100. The firm intends for 12- to 24-month long-term leases and uses major reserving sites like Airbnb and VRBO for temporary leasings. To earn money, Showed up includes an one-time sourcing fee in the share cost (3.5% of the building acquisition cost for long-term services and 5% for vacation leasings).

How do I apply for Exclusive Real Estate Deals For Accredited Investors?

Additionally, some residential or commercial properties are leveraged with a home mortgage (normally 60-70%), while others are gotten with cash money. All home mortgages are non-recourse, indicating capitalists aren't accountable for the debt and do not require to certify for credit report. In addition, each residential or commercial property is housed in a Collection LLC to protect financiers against personal responsibility and the off possibility that Showed up ever fails.

You can also access your account using an Apple application (presently, there's no Android app, however the company intends to release one in 2024). The business site has a chatbot for asking FAQs and sending out messages, which it normally responds to within a day. The site likewise details an assistance email address yet no telephone number.

Residential Real Estate For Accredited Investors

Instead, it lets actual estate enrollers use to have their deals vetted and noted on the platform. CrowdStreet offers all types of business real estate investments: multifamily, retail, office, medical structure, self-storage, industrial, and land possibilities.

According to the business, equity investors generally earn quarterly returns as a share of profits, while financial debt financiers make quarterly returns at an agreed-upon rate of interest. Circulations aren't guaranteed, and often returns aren't understood until the residential or commercial property sells. In addition, there is almost no alternative to redeem your capital or leave your investment prior to the hold duration finishes.

Crowdstreet costs genuine estate enrollers costs for making use of the platform. Those costs lower financier circulations (Accredited Investor Real Estate Partnerships).

Compared to various other systems, CrowdStreet has a high barrier to access. It's only offered to accredited financiers, and the minimal financial investment for many deals (including the private REIT) is $25,000. Customers can make offers, track their investment efficiency, and interact directly with enrollers through an on the internet portal, but no mobile application.

Who offers the best Accredited Investor Real Estate Syndication opportunities?

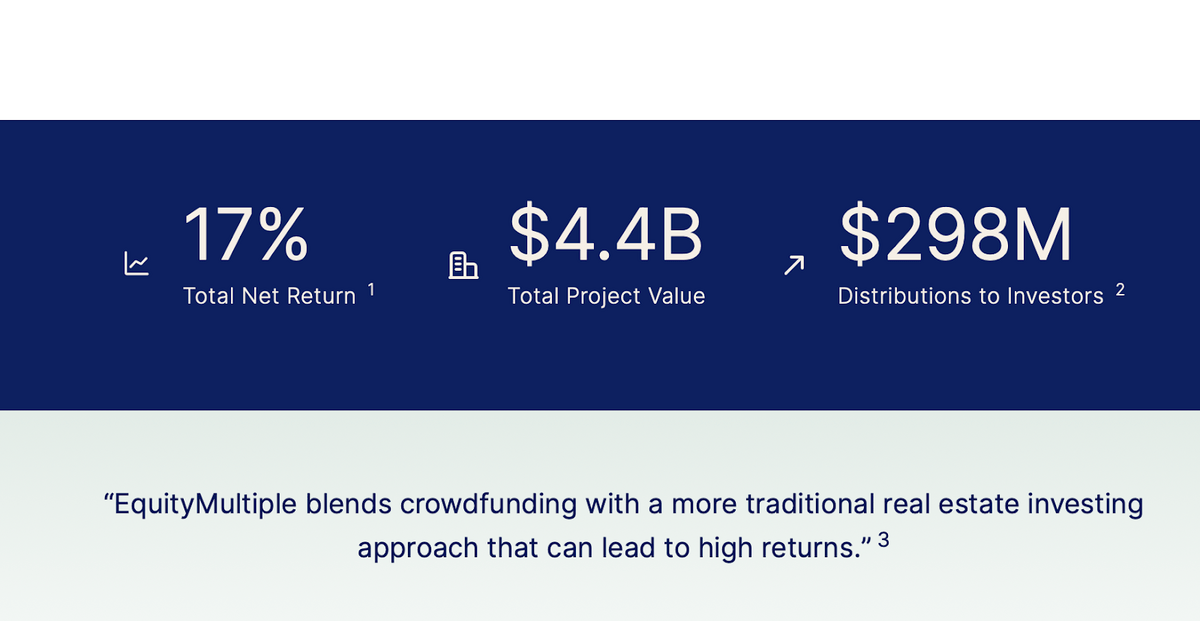

The business site has a chatbot for asking Frequently asked questions or sending messages as well as a contact email address. According to the business web site, as of 20 October 2023, CrowdStreet innovators have actually invested $4.2 billion throughout over 798 offers, of which 168 have actually been realized.

Between the industry offerings and the in-house "C-REIT," there's something for each commercial investor. Fundrise was the initial realty crowdfunding platform offered for non-accredited capitalists. It detailed its first fractionalized residential property bargain online in 2012. Ever since, the company has actually relocated to a personal REIT version. Users can select between investment plans that prefer long-lasting appreciation, supplemental revenue, or a mix of both.

We recommend Fundrise if you desire a really passive investing experience. Choose an investment strategy that fits your objectives, established auto-investing, and you're all established. RealtyMogul is an on the internet marketplace for industrial real estate deals. It also provides two private REITs: one that concentrates on creating monthly rewards for investors and an additional that targets long-lasting funding gratitude.

Depending on the deal, financiers can normally expect holding periods of 3 to 7 years. Leaving your financial investment prior to the end of the hold duration or marketing it isn't feasible. For cash-flowing properties, quarterly distributions are typical however not ensured. RealtyMogul costs realty enrollers costs for using the platform.

DiversyFund is a more recent realty crowdfunding system that launched in 2016. It has and takes care of REITs which contain one or even more multifamily properties. Some are available to non-accredited financiers for a $500 minimum investment, while others are just open to certified financiers and have minimal financial investments of approximately $50,000.

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online