All Categories

Featured

Table of Contents

RealtyMogul's minimum is $1,000. The remainder of their industrial real estate bargains are for certified investors just. Below is an in-depth RealtyMogul summary. If you want more comprehensive realty direct exposure, then you can consider purchasing an openly traded REIT. VNQ by Lead is one of the largest and well known REITs.

Their number one holding is the Vanguard Real Estate II Index Fund, which is itself a shared fund that holds a range of REITs. There are other REITs like O and OHI which I am a veteran investor of.

To be an accredited capitalist, you should have $200,000 in yearly earnings ($300,000 for joint investors) for the last two years with the assumption that you'll earn the same or much more this year. You can additionally be taken into consideration a recognized financier if you have a web well worth over $1,000,000, independently or jointly, excluding their main home.

How do I get started with Residential Real Estate For Accredited Investors?

These deals are frequently called personal positionings and they don't require to sign up with the SEC, so they do not supply as much details as you 'd anticipate from, state, an openly traded business. The accredited capitalist requirement thinks that somebody that is approved can do the due persistance by themselves.

You just self-accredit based on your word., making it simpler for more individuals to qualify. I think there will certainly be continued migration away from high price of living cities to the heartland cities due to set you back and innovation.

It's all concerning adhering to the cash. Along with Fundrise, likewise take a look at CrowdStreet if you are a certified investor. CrowdStreet is my favorite platform for recognized financiers due to the fact that they concentrate on arising 18-hour cities with lower valuations and faster populace growth. Both are cost-free to register and explore.

Below is my real estate crowdfunding dashboard. If you desire to discover more concerning actual estate crowdfunding, you can visit my realty crowdfunding finding out center. Sam operated in investing financial for 13 years. He got his undergraduate level in Business economics from The University of William & Mary and got his MBA from UC Berkeley.

He hangs out playing tennis and dealing with his family. Financial Samurai was started in 2009 and is just one of one of the most relied on personal finance websites on the web with over 1.5 million pageviews a month.

With the U.S. actual estate market on the surge, capitalists are filtering via every available residential property kind to uncover which will aid them revenue. Which industries and residential or commercial properties are the ideal actions for financiers today?

Accredited Investor Rental Property Investments

Each of these kinds will include one-of-a-kind advantages and downsides that capitalists must examine. Allow's check out each of the options available: Residential Real Estate Commercial Property Raw Land & New Construction Real Estate Investment Company (REITs) Crowdfunding Platforms Register to attend a FREE on-line property class and find out how to get going buying property.

Various other homes include duplexes, multifamily homes, and vacation homes. Residential actual estate is perfect for numerous financiers since it can be less complicated to turn earnings continually. Of course, there are many property genuine estate investing approaches to deploy and different levels of competitors across markets what may be ideal for one capitalist may not be best for the next.

Real Estate For Accredited Investors

The very best business buildings to buy include industrial, workplace, retail, hospitality, and multifamily projects. For financiers with a strong focus on boosting their regional areas, industrial actual estate investing can sustain that emphasis (Accredited Investor Real Estate Syndication). One reason industrial buildings are taken into consideration among the finest kinds of property financial investments is the potential for greater capital

To read more concerning getting begun in , be sure to read this post. Raw land investing and brand-new building and construction stand for two kinds of property investments that can expand a capitalist's profile. Raw land refers to any kind of uninhabited land offered for acquisition and is most appealing in markets with high projected growth.

Buying brand-new construction is additionally popular in swiftly growing markets. While several investors may be unknown with raw land and new building and construction investing, these financial investment kinds can stand for appealing earnings for financiers. Whether you want developing a building throughout or making money from a long-term buy and hold, raw land and new building and construction provide a special possibility to investor.

What is the process for investing in Exclusive Real Estate Deals For Accredited Investors?

This will certainly ensure you select a desirable location and protect against the financial investment from being obstructed by market elements. Realty investment company or REITs are business that have various industrial realty kinds, such as resorts, shops, workplaces, shopping malls, or dining establishments. You can purchase shares of these actual estate companies on the stock market.

It is a requirement for REITs to return 90% of their gross income to shareholders yearly. This offers investors to receive dividends while expanding their profile at the exact same time. Openly traded REITs also offer adaptable liquidity in comparison to various other kinds of property financial investments. You can offer your shares of the business on the stock market when you need reserve.

While this supplies the simplicity of locating assets to investors, this kind of property investment also presents a high quantity of danger. Crowdfunding systems are normally restricted to recognized investors or those with a high internet worth. Some websites supply access to non-accredited investors. The main kinds of property investments from crowdfunding platforms are non-traded REITs or REITs that are out the stock market.

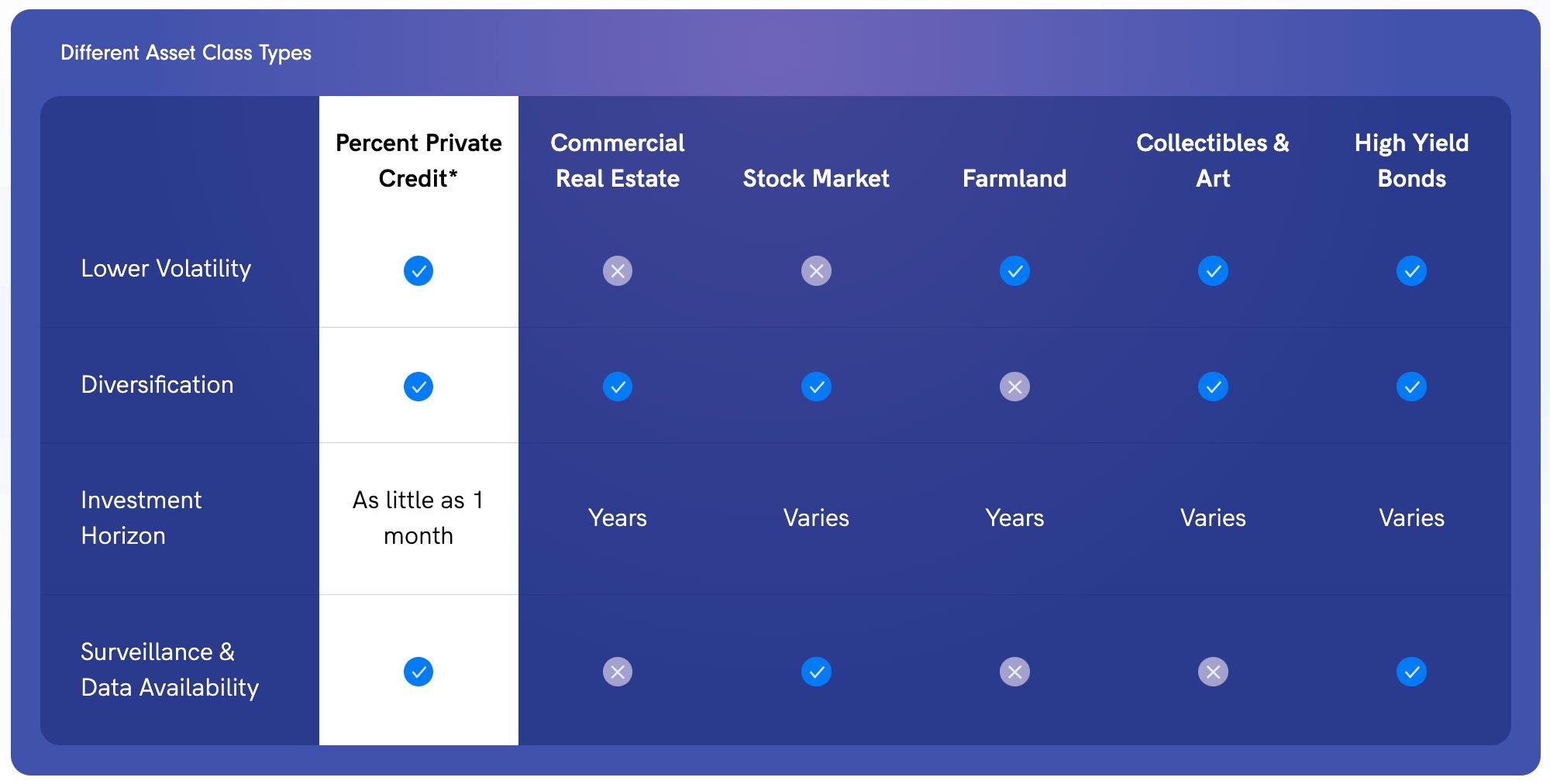

What is the difference between Accredited Investor Commercial Real Estate Deals and other investments?

The best type of real estate financial investment will certainly depend on your specific conditions, goals, market location, and preferred investing technique - Accredited Investor Real Estate Platforms.

Selecting the best property kind boils down to evaluating each option's advantages and disadvantages, though there are a few crucial aspects investors ought to keep in mind as they seek the very best selection. When picking the most effective kind of investment residential or commercial property, the relevance of area can not be underrated. Capitalists operating in "promising" markets may find success with uninhabited land or brand-new building and construction, while capitalists working in more "fully grown" markets may want residential homes.

Examine your recommended degree of participation, risk tolerance, and productivity as you make a decision which residential or commercial property type to purchase. Capitalists wishing to take on a more passive role might choose buy and hold commercial or houses and employ a home supervisor. Those intending to take on a much more active function, on the various other hand, may locate establishing uninhabited land or rehabbing residential homes to be a lot more satisfying.

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online