All Categories

Featured

Table of Contents

- – Why are Accredited Investor Commercial Real Es...

- – Can I apply for Accredited Investor Rental Pro...

- – How do I choose the right Accredited Investor...

- – What is the most popular Exclusive Real Estat...

- – What should I look for in a Accredited Inves...

- – What are the benefits of Exclusive Real Esta...

Rehabbing a house is taken into consideration an energetic financial investment approach. On the other hand, passive actual estate investing is excellent for capitalists who want to take a much less involved strategy.

With these methods, you can appreciate easy revenue gradually while enabling your investments to be handled by somebody else (such as a property administration firm). The only thing to remember is that you can lose on some of your returns by hiring a person else to manage the financial investment.

One more factor to consider to make when selecting an actual estate spending approach is straight vs. indirect. Direct investments include actually buying or managing buildings, while indirect approaches are less hands on. Numerous financiers can get so caught up in determining a home type that they don't recognize where to start when it comes to locating an actual property.

Why are Accredited Investor Commercial Real Estate Deals opportunities important?

There are lots of homes on the market that fly under the radar since investors and homebuyers don't recognize where to look. A few of these residential properties struggle with bad or non-existent marketing, while others are overpriced when listed and as a result fell short to obtain any type of focus. This suggests that those financiers ready to sort via the MLS can discover a range of investment possibilities.

In this manner, financiers can continually track or be informed to brand-new listings in their target location. For those wondering just how to make connections with realty agents in their corresponding areas, it is a good concept to participate in regional networking or property event. Financiers looking for FSBOs will likewise discover it useful to collaborate with a property agent.

Can I apply for Accredited Investor Rental Property Investments as an accredited investor?

Investors can also drive through their target areas, searching for indications to locate these residential properties. Remember, determining residential or commercial properties can take time, and capitalists ought to prepare to utilize numerous angles to safeguard their next deal. For financiers living in oversaturated markets, off-market homes can stand for an opportunity to get ahead of the competitors.

When it comes to looking for off-market residential or commercial properties, there are a couple of resources investors need to check. These include public records, actual estate auctions, dealers, networking occasions, and professionals.

How do I choose the right Accredited Investor Real Estate Syndication for me?

Years of backlogged repossessions and enhanced motivation for financial institutions to retrieve could leave also more repossessions up for grabs in the coming months. Capitalists looking for repossessions must pay cautious focus to paper listings and public records to find prospective homes.

You should consider investing in actual estate after discovering the various advantages this asset has to use. Generally, the regular demand offers actual estate reduced volatility when contrasted to various other investment kinds.

What is the most popular Exclusive Real Estate Crowdfunding Platforms For Accredited Investors option in 2024?

The factor for this is due to the fact that realty has reduced correlation to various other investment types thus offering some defenses to financiers with other asset kinds. Various types of realty investing are connected with various levels of threat, so be certain to discover the right investment method for your objectives.

The process of buying property involves making a deposit and funding the remainder of the list price. As a result, you just pay for a tiny percent of the residential or commercial property up front yet you manage the entire investment. This type of take advantage of is not offered with various other investment types, and can be made use of to further grow your financial investment portfolio.

Due to the broad selection of alternatives offered, many financiers likely find themselves wondering what actually is the best real estate investment. While this is a simple concern, it does not have a basic response. The ideal kind of investment residential or commercial property will certainly rely on lots of variables, and capitalists need to beware not to dismiss any options when searching for prospective deals.

This short article explores the possibilities for non-accredited capitalists wanting to endeavor right into the lucrative realm of property (High-Return Real Estate Deals for Accredited Investors). We will certainly look into different investment avenues, governing factors to consider, and approaches that encourage non-accredited people to harness the potential of realty in their financial investment portfolios. We will certainly additionally highlight just how non-accredited capitalists can work to become accredited investors

What should I look for in a Accredited Investor Real Estate Investment Groups opportunity?

These are generally high-net-worth individuals or companies that fulfill certification needs to trade exclusive, riskier investments. Earnings Requirements: Individuals need to have a yearly revenue going beyond $200,000 for two consecutive years, or $300,000 when combined with a partner. Internet Worth Requirement: A total assets exceeding $1 million, leaving out the main house's value.

Financial investment Understanding: A clear understanding and understanding of the dangers connected with the investments they are accessing. Paperwork: Capacity to offer financial declarations or various other paperwork to verify revenue and web well worth when requested. Real Estate Syndications need accredited financiers because sponsors can only allow certified financiers to register for their investment chances.

What are the benefits of Exclusive Real Estate Crowdfunding Platforms For Accredited Investors for accredited investors?

The first typical false impression is as soon as you're an accredited investor, you can maintain that status forever. Certification lasts for five years and should be resubmitted for approval upon that target date. The second misunderstanding is that you have to strike both financial standards. To come to be a recognized financier, one should either hit the income standards or have the internet worth requirement.

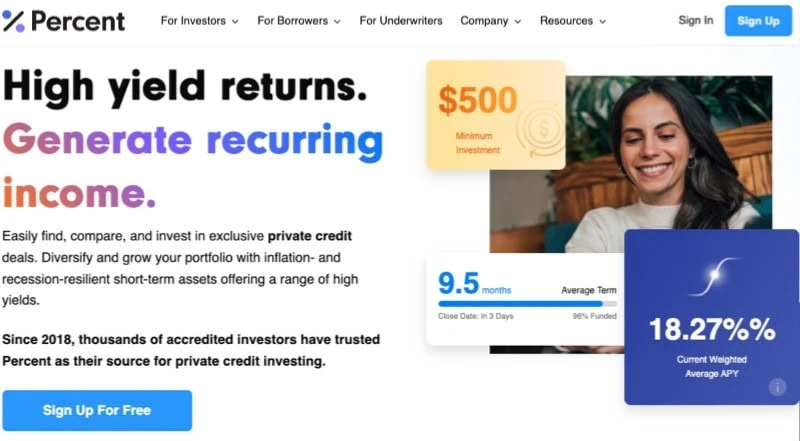

REITs are attractive because they generate more powerful payments than traditional supplies on the S&P 500. High return dividends Profile diversity High liquidity Rewards are taxed as average income Sensitivity to passion rates Risks related to details properties Crowdfunding is an approach of on-line fundraising that includes requesting the general public to contribute cash or start-up resources for new projects.

This permits entrepreneurs to pitch their concepts straight to day-to-day internet individuals. Crowdfunding supplies the capability for non-accredited investors to end up being shareholders in a firm or in a real estate residential property they would certainly not have actually had the ability to have accessibility to without certification. Another benefit of crowdfunding is profile diversification.

The 3rd advantage is that there is a lower barrier to entry. In some situations, the minimum is $1,000 bucks to spend in a business. Oftentimes, the financial investment candidate needs to have a record and is in the infancy stage of their task. This can suggest a higher risk of shedding a financial investment.

Table of Contents

- – Why are Accredited Investor Commercial Real Es...

- – Can I apply for Accredited Investor Rental Pro...

- – How do I choose the right Accredited Investor...

- – What is the most popular Exclusive Real Estat...

- – What should I look for in a Accredited Inves...

- – What are the benefits of Exclusive Real Esta...

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online

More

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online