All Categories

Featured

Passion is only paid when a tax obligation lien is retrieved. Property comes to be tax-defaulted land if the property tax obligations continue to be unsettled at 12:01 a.m. on July 1st.

Residential property that has actually come to be tax-defaulted after five years( or three years in the situation of residential or commercial property that is likewise based on a nuisance abatement lien)becomes subject to the area tax obligation enthusiast's power to sell in order to please the defaulted property tax obligations. The county tax obligation enthusiast might provide the building for sale at public auction, a secured quote sale, or a worked out sale to a public agency or qualified nonprofit company. Public public auctions are the most common method of selling tax-defaulted building. The public auction is carried out by the county tax collection agency, and the home is offered to the highest possible prospective buyer. You're wondering concerning getting tax obligation liens in Texas? It looks like a reasonably reduced price due to the fact that you're paying any liens versus the building rather

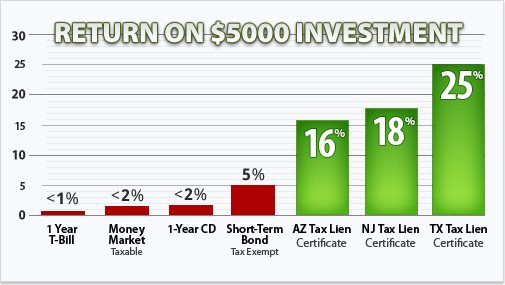

of getting the home itself. It can not be that very easy, can it? Yes And no. Acquiring tax liens in Texas isn't perfect for brand-new investors because it's a complicated process that can cost you a fair bit if you aren't mindful. Texas doesn't offer the lien itself. The state offers residential or commercial properties that are tax-delinquent at auction. The residential property's proprietor can redeem their residential property within a redemption duration, yet they'll deal with a 25% to 50%penalty. As the lienholder, you'll get the 25%to 50%charge the original proprietor has to pay to obtain their home back in addition to any type of costs you paid to get that property. If the property owner does not pay the owed taxes, the capitalist deserves to take the action to the residential or commercial property within a redemption duration.

Best Book On Tax Lien Investing

Keep in mind: The redemption period is normally 180 days, yet it can be as long as two years if the residential property is a domestic homestead or land designated for farming use. A lot of jurisdictions need you to pay residential property taxes by January 31. You are overdue if the taxes haven't been paid by February 1st. When a residential or commercial property has a tax obligation

lien certification positioned versus it, the certification will be auctioned off to the highest bidder. The public auctions can happen online or in individual. As an investor, you generate income when the homeowner repays the tax obligation debt plus passion. If the homeowner doesn't pay the debt within a practical period(the.

Invest Tax Liens

details timespan will certainly differ depending on the straining authority and neighborhood market ), the lienholder can seize on the residential or commercial property - tax lien investing guide. An additional advantage of buying tax obligation liens is that you can conveniently compute the price of return. Because you're paid a round figure when the lien deals with, you 'll be able to find out just how much you're getting and your price of return. There's a whole lot to be gotten when investing in tax obligation liens, the dangers should not be glossed over. This can be problematic since it will certainly need even more cash than initially prepared for. One more threat is that the building you're bidding on might be in bad problem, the property may have suffered ecological damages, or chemicals, or dangerous products might pollute the home. There's the issue of revenue. Unlike investing in rental buildings that create a monthly income, your income is one round figure. In the odd possibility that the home proprietor does not redeem their residential or commercial property, you'll require to find out what you'll finish with the home after the repossession concludes. What can you do? Well, you can lease it, offer it, or keep it. If you choose to rent the residential or commercial property,

you've secured a month-to-month earnings as soon as you've discovered a tenant. They'll do all of the job for you, for a cost. But, that might be worth it to you. If you desire an instant cash advance, after that offering the home may be a better alternative. You can take the cash from the sale and reinvest it however you choose.

Allow's claim you acquired a tax obligation lien for $20,000. If you like the area the residential property is located in, you can absolutely maintain the home and utilize it as a 2nd home.

Given that it's your own, you also have the choice to put the property on Airbnb when you're not there. Considering that real estate tax liens are a greater priority than all other liens, the home mortgage is cleaned away if the residential property is purchased by means of tax foreclosure sale. Surprisingly, a finance servicer may advance money to pay overdue residential or commercial property tax obligations to avoid the residential property from going right into foreclosure. Certainly, the loan servicer will certainly require the borrower to pay the sophisticated refund. If the lending servicer does advancement cash to pay the delinquent property tax obligations and you do not pay it back, the home can still be confiscated on. Note: It's always in your best interest to look titles for liens both legit and bogus. Where do you discover residential properties with tax liens on the auction block? Government firms( the region recorder, staff, or assessor's workplace )in Texas use totally free lien searches to the public online, as they are public records. The auctions must be promoted in the neighborhood paper once a week for three weeks prior to the public auction. If you're still thinking about purchasing tax liens in Texas, then we have a few pointers that 'll work prior to obtaining started. It would certainly be best to bear in mind that buying a tax lien certification does not suggest you're the building's rightful owner. You earn money when the homeowner pays their financial debts, but if you leave with a building, think about it as a welcome surprise. The region enforces tax liens, so you will be taking care of the area when you buy the tax obligation lien certifications. You require to acquaint yourself with the county regulations to know specifically what to anticipate. Yet keeping that said, all areas need to hold their auctions on the very first Tuesday of the month unless it's a legal holiday, obviously. We stated above that purchasing tax liens shouldn't be the only point in your profile. It's an excellent thing to have, however you don't intend to put all your eggs into one basket. Diving right into the world of buying tax liens isn't something you need to do without mindful factor to consider and great deals of research study especially if you intend to make this a significant element of your portfolio. Smart investors can make a rather cent when they recognize the ins and outs of the method. Financiers are typically brought in to home tax obligation liens/tax acts due to

the reasonably low funding essential, the potential returns and the capability to be involved in realty without much of the responsibility of having the real residential property. A tax obligation lien is a lien troubled the building by law to safeguard payment of taxes. It is enforced by the region in which the property islocated. An investor will buy the lien from the county for the opportunity of either lucrative outcomes: The lien can be redeemed, implying the owner will certainly pay the lien amount plus rate of interest (a rate that is established by each state) to the investor. Some states do not provide tax lien financial investments, however instead tax deeds. A tax obligation action sale is the forced sale carried out by a governmental firm of property for nonpayment of taxes. In this situation, a capitalist has a possibility to purchase a residential or commercial property action at discount. Like lots of other possessions, it's possible to buy tax obligation liens using your IRA, 401 (k ), or other retirement account. Purchasing tax liens and actions with self-directed IRAs are attractive investment methods since they are somewhat easy and cost-effective to obtain and handle. And, they have the prospective to make a preferable return on the first investment. When you utilize retirement funds to invest, the liens and/or deeds are acquired by the self-directed individual retirement account and are owned by the IRA. Advanta IRA looks after lots of financial investments in tax obligation liens andacts in self-directed Individual retirement accounts. While these investments have the possible to supply strong returns, just like any type of financial investment, due persistance is essential, and looking for the appropriate suggestions from specialists is recommended. Tax obligation liens are connected to property when proprietors fail to pay annual real estate tax. Ruling agencies offer these liens at online or on-line auctions. Financiers who win the proposal pay the taxes due. The capitalist designates and gathers a collection rates of interest and costs from the homeowner. The property owner has a set durations pay the capitalist to get the lien launched from the residential or commercial property. In situation of default, the capitalist can take possession of the residential property and can market it outrightanother way to earn revenue. Tax acts function just like tax liens when real estate tax remain in arrearswith one crucial exemption: the federal government or municipality takes instant ownership of building. Tax obligation acts are after that cost auction, and the investor with the highest possible proposal wins possession of that residential or commercial property. In 28 states, towns and counties might provide a tax lien certification permitting the certificate proprietor to claim the property until the taxes and any kind of affiliated costs are paid off and market it to the highest prospective buyer. Exactly how can you invest in tax liens? Lienholders can charge the home proprietor a rate of interest and consist of any kind of charge fees or premiums in their payment plan. The property can go right into foreclosure when the house owner does not come to be existing with the overdue taxes and fines. In the USA , 28 states permit the government to offer tax obligation lien certificates to personal investors. For more details in your area, get in touch with your local tax revenue workplace. Tax liens can be cost a cash money amount, or the rates of interest a prospective buyer agrees to accept. While home owners have a specific amount of time to settle up their tax obligation bills, the investor is accountable for paying when they take belongings of the tax lien certificate. If the property owner pays the back tax obligations and penalties, the investor recoups their cash without taking ownership of the property. Homeowners that do not pay go into foreclosure. Both tax obligation liens and tax obligation acts are effects property owners must encounter when property tax obligations go unsettled. Unlike a tax lien, a tax action transfers the title of the property itself and any rights connected to it to the customer. Some states enable the homeowner to pay back their overdue real estate tax and any fees and charges to redeem their civil liberties to the building. Sometimes, financiers acquire the tax obligation lien certificates for as reduced as a few hundred bucks. Tax lien investing likewise enables charging greater prices than other kinds of investing. The maximum rate of interest varies by state, but keep in mind that your returns will certainly be lower if you bid on the interest rate at auction. Like any type of form of investing, tax lien investing is not without threats. Tax obligation lien investing requires a considerable quantity of research study and property expertise from the capitalist to be lucrative. The property worth needs to be dramatically greater than the quantity of tax due.

Latest Posts

Real Estate Tax Lien Investments

What is the best way to compare Exclusive Real Estate Deals For Accredited Investors options?

What are the benefits of Accredited Investor Property Investment Opportunities for accredited investors?

More

Latest Posts

Real Estate Tax Lien Investments

What is the best way to compare Exclusive Real Estate Deals For Accredited Investors options?

What are the benefits of Accredited Investor Property Investment Opportunities for accredited investors?