All Categories

Featured

Table of Contents

The interpretation of an accredited financier (if any kind of), and the repercussions of being identified as such, differ between nations.

It defines advanced capitalists to make sure that they can be dealt with as wholesale (as opposed to retail) customers. According to ASIC, a person with a sophisticated investor certification is a sophisticated investor for the objective of Phase 6D, and a wholesale client for the objective of Phase 7. On December 17, 2014, CVM released the Directions No.

A corporation integrated abroad whose activities are comparable to those of the companies laid out over (cryptocurrency accredited investor). s 5 of the Securities Act (1978) defines an advanced capitalist in New Zealand for the objectives of subsection (2CC)(a), a person is well-off if an independent chartered accounting professional licenses, no even more than 12 months before the deal is made, that the legal accountant is satisfied on reasonable premises that the person (a) has web properties of at least $2,000,000; or (b) had an annual gross revenue of a minimum of $200,000 for each and every of the last two fiscal years

"Spousal matching" to the certified capitalist definition, so that spousal equivalents might pool their financial resources for the objective of qualifying as accredited financiers. Recovered 2015-02-28."The New CVM Instructions (Nos.

Accredited Investor Crowdfunding Sites

17 C.F.R. sec. BAM Resources."Even More Capitalists Might Get Accessibility to Exclusive Markets.

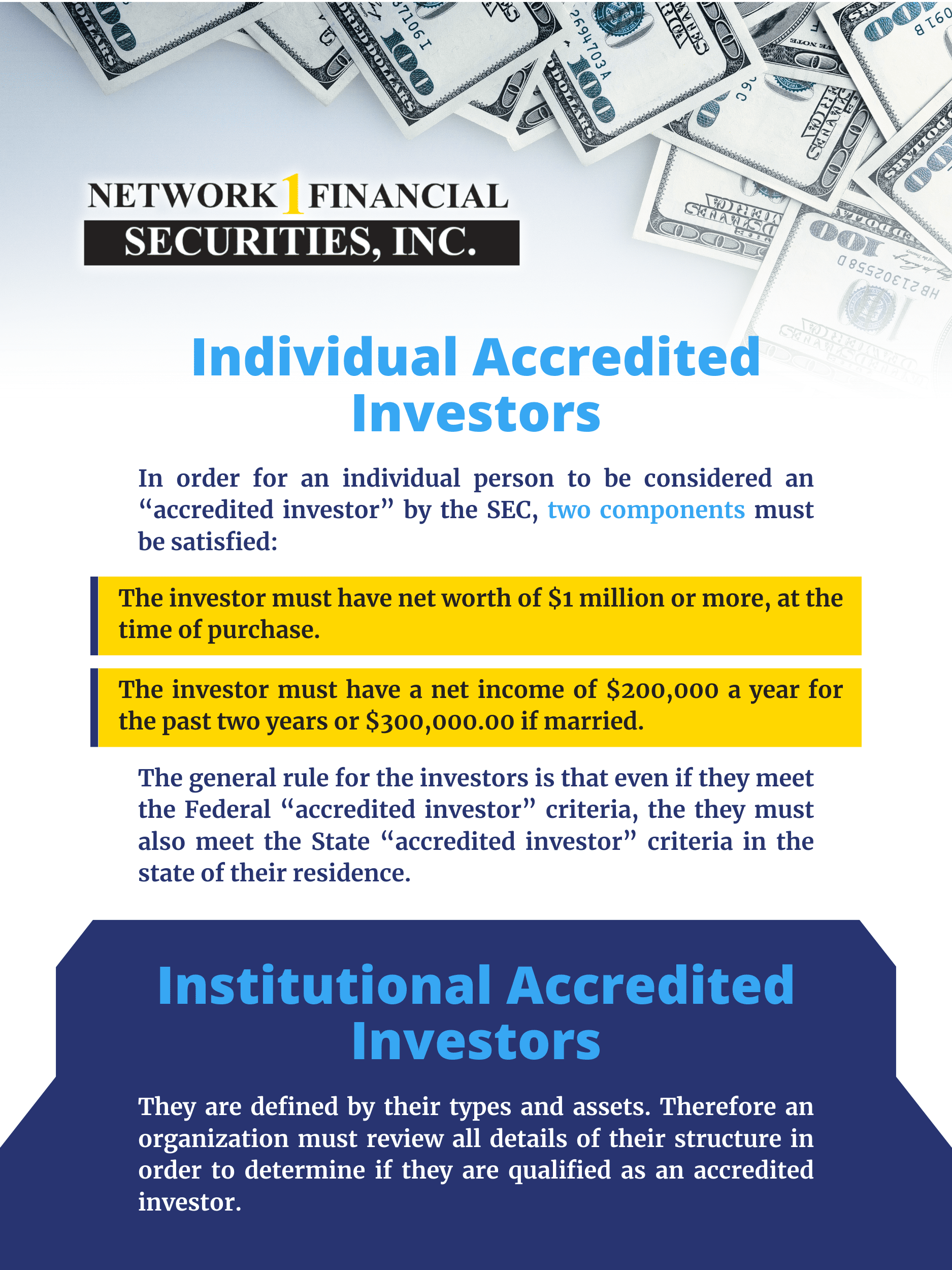

Accredited investors consist of high-net-worth individuals, banks, insurance provider, brokers, and counts on. Approved capitalists are defined by the SEC as qualified to purchase complicated or advanced sorts of securities that are not carefully controlled - accredited real estate funds. Certain requirements should be met, such as having a typical yearly revenue over $200,000 ($300,000 with a spouse or cohabitant) or working in the monetary industry

Non listed safeties are inherently riskier since they do not have the regular disclosure demands that come with SEC registration. Investopedia/ Katie Kerpel Accredited capitalists have blessed accessibility to pre-IPO companies, endeavor resources companies, hedge funds, angel investments, and different offers involving complex and higher-risk investments and tools. A firm that is looking for to raise a round of funding may determine to directly approach certified capitalists.

It is not a public business but wants to launch a going public (IPO) in the future. Such a firm might determine to provide safety and securities to accredited financiers straight. This sort of share offering is described as a exclusive placement. verify series 7 license. For recognized financiers, there is a high capacity for danger or reward.

If Investor

The policies for recognized investors differ amongst jurisdictions. In the U.S, the meaning of an approved capitalist is put forth by the SEC in Regulation 501 of Guideline D. To be an accredited capitalist, a person must have an annual revenue going beyond $200,000 ($300,000 for joint earnings) for the last two years with the assumption of earning the very same or a greater income in the current year.

A recognized capitalist needs to have a total assets going beyond $1 million, either independently or jointly with a spouse. This quantity can not consist of a primary house. The SEC also considers applicants to be approved capitalists if they are basic partners, executive policemans, or supervisors of a company that is issuing non listed protections.

Non-accredited Investors

If an entity consists of equity owners who are approved investors, the entity itself is a certified investor. Nevertheless, a company can not be developed with the sole function of buying particular protections. A person can certify as an approved financier by showing sufficient education or task experience in the economic market.

Individuals that wish to be certified investors don't apply to the SEC for the classification. accredited investing. Instead, it is the responsibility of the company using a personal placement to make certain that every one of those come close to are recognized investors. People or parties that intend to be approved capitalists can come close to the provider of the unregistered securities

Accredited Investor Questionnaire Form

Suppose there is a private whose revenue was $150,000 for the last three years. They reported a primary house worth of $1 million (with a home mortgage of $200,000), a cars and truck worth $100,000 (with an outstanding funding of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

This individual's web worth is precisely $1 million. Given that they fulfill the net well worth need, they certify to be a certified financier.

There are a couple of much less usual qualifications, such as taking care of a trust with greater than $5 million in possessions. Under federal protections laws, only those that are certified investors might join certain securities offerings. These may include shares in personal positionings, structured products, and private equity or bush funds, to name a few.

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online