All Categories

Featured

Table of Contents

- – How do I apply for Real Estate For Accredited ...

- – What is a simple explanation of High-return Re...

- – Why is Accredited Investor Real Estate Invest...

- – How do I choose the right Commercial Property...

- – Who offers flexible Residential Real Estate ...

- – What is a simple explanation of Real Estate ...

For instance, rehabbing a home is considered an energetic financial investment approach. You will supervise of working with improvements, managing contractors, and inevitably making sure the property offers. Active techniques require more time and initiative, though they are linked with big profit margins. On the other hand, easy realty investing is terrific for investors who desire to take a much less involved approach.

With these approaches, you can enjoy passive income gradually while enabling your financial investments to be taken care of by somebody else (such as a home monitoring company). The only thing to keep in mind is that you can lose on a few of your returns by hiring another person to manage the financial investment.

Another consideration to make when choosing a real estate spending technique is straight vs. indirect. Direct investments entail actually purchasing or managing residential or commercial properties, while indirect methods are much less hands on. Many financiers can obtain so captured up in recognizing a property kind that they do not understand where to begin when it comes to finding a real residential or commercial property.

How do I apply for Real Estate For Accredited Investors?

There are heaps of buildings on the market that fly under the radar since financiers and homebuyers do not know where to look. A few of these residential properties deal with poor or non-existent advertising, while others are overpriced when detailed and as a result stopped working to get any focus. This implies that those financiers happy to arrange through the MLS can find a variety of financial investment possibilities.

This way, investors can regularly track or look out to brand-new listings in their target area. For those questioning just how to make links with realty representatives in their corresponding areas, it is a great concept to go to regional networking or genuine estate occasion. Investors searching for FSBOs will likewise discover it beneficial to function with a real estate representative.

What is a simple explanation of High-return Real Estate Deals For Accredited Investors?

Capitalists can likewise drive via their target locations, looking for signs to locate these homes. Keep in mind, identifying homes can take time, and capitalists should be prepared to use multiple angles to protect their following deal. For investors living in oversaturated markets, off-market residential properties can represent an opportunity to get in advance of the competition.

When it comes to looking for off-market buildings, there are a couple of resources financiers must examine. These include public documents, property public auctions, dealers, networking occasions, and service providers. Each of these sources represents a special chance to locate residential or commercial properties in a provided area. Wholesalers are commonly conscious of newly rehabbed residential or commercial properties offered at practical costs.

Why is Accredited Investor Real Estate Investment Groups a good choice for accredited investors?

Years of backlogged repossessions and enhanced motivation for financial institutions to repossess could leave also extra foreclosures up for grabs in the coming months. Financiers browsing for repossessions need to pay cautious attention to paper listings and public records to discover possible properties.

You must consider purchasing real estate after finding out the different advantages this property needs to use. Historically, property has executed well as an asset course. It has a positive partnership with gross residential item (GDP), indicating as the economic situation grows so does the demand genuine estate. Generally, the regular demand uses realty lower volatility when compared to various other investment types.

How do I choose the right Commercial Property Investments For Accredited Investors for me?

The factor for this is due to the fact that realty has reduced correlation to various other investment types hence supplying some defenses to financiers with other possession types. Different sorts of property investing are related to various levels of threat, so make sure to discover the ideal investment strategy for your goals.

The procedure of acquiring residential or commercial property involves making a down payment and financing the remainder of the sale cost. Because of this, you just spend for a tiny percentage of the residential or commercial property in advance but you regulate the whole investment. This kind of utilize is not readily available with other investment kinds, and can be used to more grow your financial investment portfolio.

Due to the broad range of options readily available, several investors likely discover themselves wondering what really is the best actual estate financial investment. While this is a simple inquiry, it does not have a straightforward answer. The most effective sort of financial investment home will certainly depend on many aspects, and capitalists must beware not to rule out any alternatives when looking for prospective deals.

This article discovers the possibilities for non-accredited investors aiming to venture right into the rewarding world of realty (Accredited Investor Property Investment Opportunities). We will dig into numerous investment opportunities, regulative considerations, and methods that equip non-accredited individuals to harness the potential of property in their financial investment profiles. We will likewise highlight just how non-accredited capitalists can function to come to be recognized investors

Who offers flexible Residential Real Estate For Accredited Investors options?

These are generally high-net-worth people or companies that fulfill accreditation demands to trade personal, riskier investments. Income Criteria: Individuals need to have a yearly revenue exceeding $200,000 for 2 consecutive years, or $300,000 when incorporated with a partner. Web Worth Need: A net worth surpassing $1 million, leaving out the main house's value.

Financial investment Understanding: A clear understanding and understanding of the dangers connected with the financial investments they are accessing. Documentation: Capacity to give economic declarations or other paperwork to validate income and internet worth when asked for. Realty Syndications require certified financiers since enrollers can only permit recognized financiers to register for their investment opportunities.

What is a simple explanation of Real Estate Investment Funds For Accredited Investors?

The very first common misconception is as soon as you're an accredited investor, you can maintain that standing forever. To become an accredited financier, one must either hit the income criteria or have the web well worth demand.

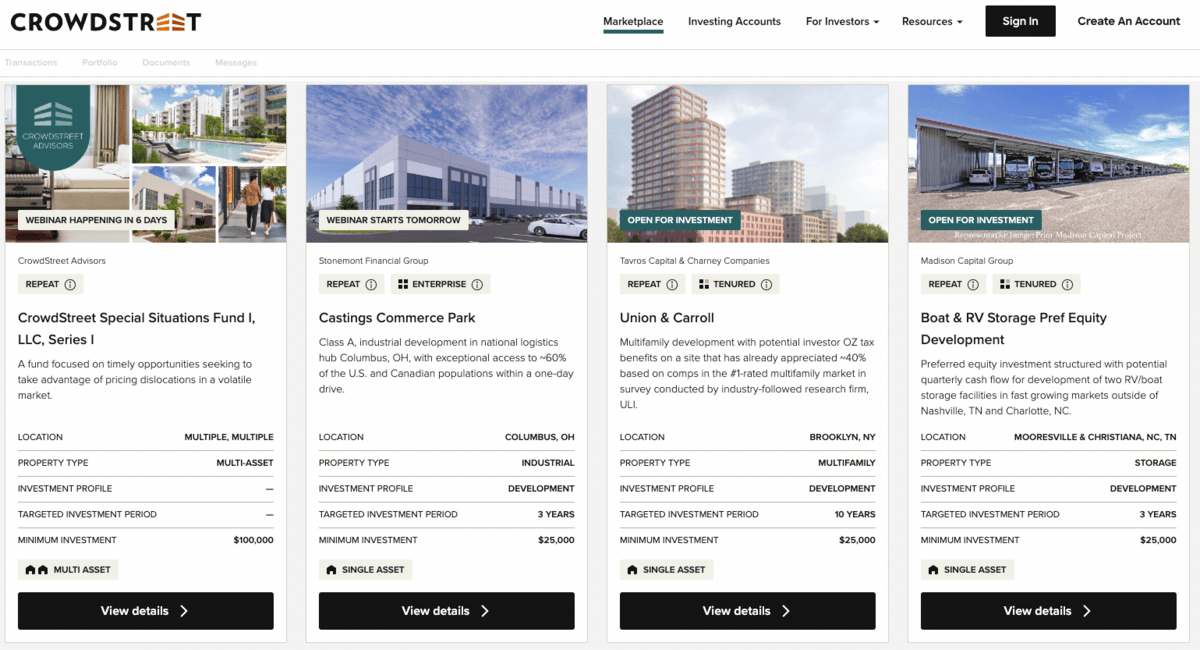

REITs are appealing because they yield stronger payments than typical stocks on the S&P 500. High return dividends Portfolio diversification High liquidity Dividends are taxed as common income Level of sensitivity to rates of interest Threats associated with specific homes Crowdfunding is a technique of online fundraising that entails requesting the general public to contribute cash or start-up resources for brand-new jobs.

This allows entrepreneurs to pitch their ideas directly to day-to-day net individuals. Crowdfunding supplies the capacity for non-accredited investors to come to be shareholders in a firm or in a realty residential or commercial property they would certainly not have had the ability to have access to without accreditation. One more advantage of crowdfunding is portfolio diversity.

In several instances, the investment candidate requires to have a track document and is in the infancy phase of their job. This might mean a higher threat of losing a financial investment.

Table of Contents

- – How do I apply for Real Estate For Accredited ...

- – What is a simple explanation of High-return Re...

- – Why is Accredited Investor Real Estate Invest...

- – How do I choose the right Commercial Property...

- – Who offers flexible Residential Real Estate ...

- – What is a simple explanation of Real Estate ...

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online

More

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online