All Categories

Featured

A financial investment lorry, such as a fund, would certainly have to determine that you qualify as a recognized investor - sec rule 501 regulation d. To do this, they would certainly ask you to fill in a questionnaire and perhaps offer certain documents, such as economic statements, credit rating records. accredited investor rule 501 regulation d, or income tax return. The advantages of being an accredited investor consist of access to special investment possibilities not offered to non-accredited capitalists, high returns, and boosted diversity in your portfolio.

In specific areas, non-accredited investors additionally can rescission (investor requirement). What this implies is that if an investor determines they want to draw out their money early, they can assert they were a non-accredited financier during and get their refund. However, it's never a good idea to give falsified records, such as phony tax returns or economic statements to an investment lorry simply to spend, and this could bring legal difficulty for you down the line - individual investor definition.

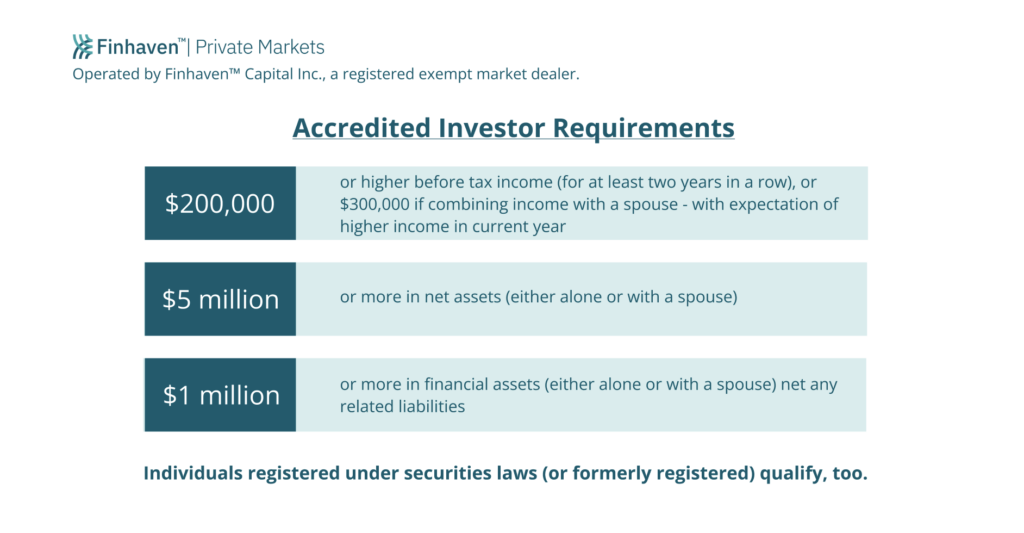

That being said, each bargain or each fund may have its very own limitations and caps on investment quantities that they will accept from a capitalist. Recognized investors are those that fulfill specific demands pertaining to revenue, qualifications, or web well worth.

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online