All Categories

Featured

Table of Contents

- – Real Estate Investment Funds For Accredited In...

- – Real Estate Syndication For Accredited Investors

- – What does Accredited Investor Real Estate Syn...

- – How long does a typical Private Real Estate D...

- – What does a typical Accredited Investor Real...

- – Where can I find affordable Accredited Inves...

Rehabbing a home is thought about an active financial investment technique - Accredited Investor Property Portfolios. You will certainly supervise of working with improvements, looking after specialists, and eventually ensuring the residential property sells. Active strategies require even more time and initiative, though they are associated with large earnings margins. On the various other hand, easy real estate investing is fantastic for financiers who wish to take a much less engaged method.

With these techniques, you can take pleasure in easy earnings gradually while allowing your investments to be managed by a person else (such as a residential property administration firm). The only thing to bear in mind is that you can lose on a few of your returns by hiring somebody else to take care of the financial investment.

An additional consideration to make when selecting a property spending method is straight vs. indirect. Comparable to active vs. passive investing, direct vs. indirect describes the degree of participation needed. Direct financial investments involve actually acquiring or managing properties, while indirect approaches are much less hands on. As an example, REIT spending or crowdfunded residential properties are indirect real estate financial investments.

Register to attend a FREE on-line property class and learn exactly how to begin buying actual estate.] Several investors can obtain so caught up in determining a property kind that they do not know where to start when it involves locating a real home. As you familiarize yourself with various residential property kinds, additionally be sure to learn where and how to discover each one.

Real Estate Investment Funds For Accredited Investors

There are heaps of homes on the market that fly under the radar since financiers and property buyers don't understand where to look. Several of these buildings experience from bad or non-existent advertising, while others are overpriced when provided and consequently fell short to obtain any kind of attention. This indicates that those capitalists going to arrange through the MLS can discover a variety of investment chances.

By doing this, investors can consistently track or be notified to new listings in their target area. For those questioning exactly how to make links with property agents in their particular locations, it is a good concept to participate in local networking or real estate event. Capitalists browsing for FSBOs will certainly likewise locate it helpful to deal with a property agent.

Real Estate Syndication For Accredited Investors

Investors can also drive through their target locations, searching for indicators to locate these buildings. Remember, identifying buildings can require time, and financiers should be prepared to utilize several angles to safeguard their next bargain. For capitalists staying in oversaturated markets, off-market properties can represent a chance to prosper of the competitors.

When it pertains to searching for off-market properties, there are a couple of sources investors must inspect initially. These include public records, realty public auctions, dealers, networking occasions, and specialists. Each of these resources represents an one-of-a-kind opportunity to find buildings in a provided area. Wholesalers are usually mindful of freshly rehabbed properties offered at sensible prices.

What does Accredited Investor Real Estate Syndication entail?

Years of backlogged foreclosures and raised inspiration for banks to retrieve might leave also much more repossessions up for grabs in the coming months. Investors searching for repossessions must pay careful interest to paper listings and public documents to discover possible buildings.

You need to consider spending in genuine estate after learning the numerous benefits this possession has to offer. Generally, the consistent need provides actual estate reduced volatility when compared to various other investment kinds.

How long does a typical Private Real Estate Deals For Accredited Investors investment last?

The reason for this is due to the fact that actual estate has low correlation to various other financial investment types thus offering some securities to financiers with various other asset kinds. Different types of property investing are related to various levels of risk, so make certain to discover the appropriate investment method for your goals.

The process of getting home includes making a down settlement and funding the remainder of the price. Because of this, you only spend for a tiny percentage of the building up front yet you manage the entire investment. This kind of leverage is not readily available with various other financial investment kinds, and can be used to further expand your investment profile.

Due to the large range of options readily available, numerous financiers most likely locate themselves questioning what really is the finest actual estate financial investment. While this is a basic question, it does not have a straightforward solution. The very best sort of financial investment property will depend upon several factors, and financiers should be cautious not to rule out any type of choices when looking for potential deals.

This write-up discovers the opportunities for non-accredited investors seeking to venture right into the profitable realm of realty (Accredited Investor Rental Property Investments). We will certainly look into various investment avenues, regulatory considerations, and approaches that empower non-accredited people to harness the possibility of realty in their investment profiles. We will certainly also highlight just how non-accredited investors can function to become accredited financiers

What does a typical Accredited Investor Real Estate Crowdfunding investment offer?

These are typically high-net-worth individuals or business that satisfy certification demands to trade private, riskier investments. Revenue Criteria: Individuals must have an annual earnings going beyond $200,000 for two successive years, or $300,000 when integrated with a partner. Internet Worth Requirement: A web well worth going beyond $1 million, excluding the main residence's value.

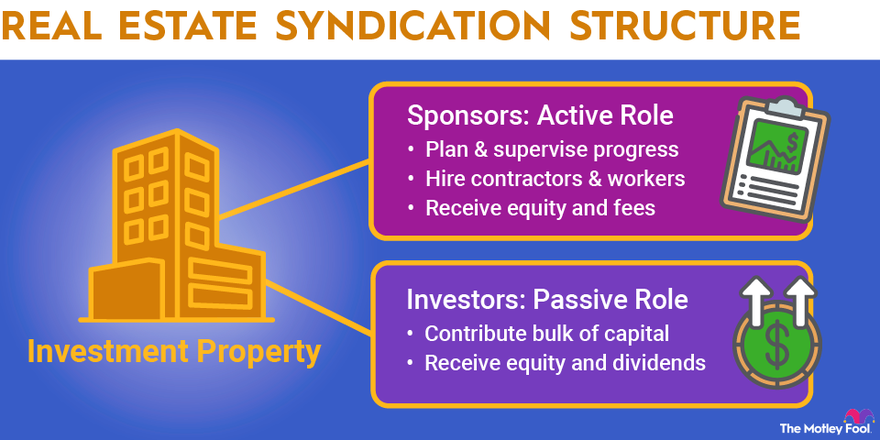

Financial investment Understanding: A clear understanding and awareness of the dangers related to the financial investments they are accessing. Documentation: Capacity to provide financial statements or various other documentation to validate income and web well worth when asked for. Property Syndications need certified capitalists due to the fact that enrollers can just enable recognized financiers to subscribe to their financial investment possibilities.

Where can I find affordable Accredited Investor Rental Property Investments opportunities?

The first typical mistaken belief is once you're a certified investor, you can keep that condition indefinitely. To become an accredited financier, one have to either strike the earnings standards or have the net worth need.

REITs are appealing due to the fact that they generate stronger payments than traditional stocks on the S&P 500. High return dividends Profile diversification High liquidity Returns are strained as common revenue Level of sensitivity to interest prices Threats associated with details properties Crowdfunding is an approach of online fundraising that includes requesting the general public to add money or start-up resources for brand-new jobs.

This allows business owners to pitch their concepts straight to daily web customers. Crowdfunding uses the capacity for non-accredited capitalists to become investors in a business or in a real estate property they would not have had the ability to have access to without certification. One more benefit of crowdfunding is portfolio diversification.

In many situations, the investment applicant needs to have a track document and is in the infancy phase of their task. This might suggest a greater threat of losing an investment.

Table of Contents

- – Real Estate Investment Funds For Accredited In...

- – Real Estate Syndication For Accredited Investors

- – What does Accredited Investor Real Estate Syn...

- – How long does a typical Private Real Estate D...

- – What does a typical Accredited Investor Real...

- – Where can I find affordable Accredited Inves...

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online

More

Latest Posts

Government Tax Foreclosure

Tax Houses For Sale Near Me

Investing In Tax Liens Online